Risk Management in Banks: Determination of Practices and.

Risk management dissertation topics evaluate students' grasp on risk identification and assessment. Additionally, risk management research topics help find solutions towards minimization of the risks identified, where possible. The following is a list of risk management thesis topics to help students identify relevant topics and draft a paper.

Risk management has three basic components: prevention of injury, financing for risks, and the management of claims. It is very easy to write a risk management dissertation. All you have to do is pick Risk management dissertation topics that are of your interest. To pick a risk management dissertation topic you have to follow the same.

RISK MANAGEMENT IN BANKS: DETERMINATION OF PRACTICES AND RELATIONSHIP WITH PERFORMANCE MUHAMMAD ISHTIAQ Abstract The issue of risk management in banks has become the centre of debate after the recent financial crises. Several efforts have been made to improve the risk.

Modelling risk management in Nigerian banks brings attention to the essence of banks paying adequate attention to the inherent risks in their operation and explains how these risks are identified, measured, analyzed, and controlled. Banks are also encouraged to have a risk management culture that uses the Bow-Tie Technique, where the.

Credit Risk Management in today’s deregulated market is a big challenge. Increased market volatility has brought with it the need for smart analysis and specialized applications in managing credit risk. A well defined policy framework is needed to help the operating staff identify the risk-event, assign a probability to each, quantify the.

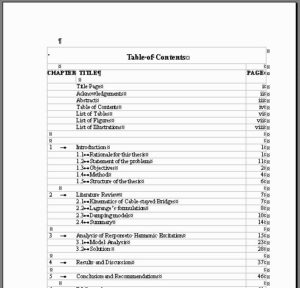

Risk Management Risk at different hierarchy levels of banks Micro level Macro Level Strategic level Risk Management Flow Chart Risk Management in Banks Framework of Risk Management Integration of Risk Management Accountability Risk Evaluation Independent review 3: Research Methodology Research Onion Philosophy behind the study Research approach.

Risks Management And Assessing The Risk Management Strategies. Chapter 1: Background 1.1 Introduction to the Organization. J.P Morgan Chase headquartered in New York is the leader in the financial services providing solutions to clients in more than hundred countries possessing one of the most comprehensive global platforms.

Uganda used to support effective risk-management practices. This multiple case study was an in-depth inquiry into compensation strategies that encouraged prudent risk-taking behavior. The target population comprised 5 risk-management executives from 5 separate commercial banks who had successfully implemented compensation strategies that.

Thesis Research Proposal on Risk Management Practices and Risk Management Processes of Islamic Banks This paper proposes a research framework on risk management practices and the aspects of risk management processes.

Risk Management at the Strategic and Operational Levels of Swiss Banks: Current Status and Lessons Learned from the Subprime Crisis. DISSERTATION of the University of St.Gallen, School of Management, Economics, Law, Social Sciences and International Affairs to obtain the title of Doctor of Philosophy in Management. submitted by. Goran. from.

At we have a team of MA and dissertation report on risk management in banks PhD qualified experts working tirelessly to provide high quality customized writing solutions to all your assignments including essays, term papers, research papers, dissertations, coursework and dissertation report on risk management in banks projects.

Credit Risk Management in Ghanaian Commercial Banks - Michael Nyarko-Baasi - Master's Thesis - Business economics - Investment and Finance - Publish your bachelor's or master's thesis, dissertation, term paper or essay.

Liquidity Risk and Asset Pricing: Evidence from the Chinese Stock Market Xinyi Lou, 2018. The Effect of Asset Securitization on Liquidity Risk in Chinese Commercial Banks Qian Lu, 2018. The Dynamic Relationship between Property and Stock Market in China Like Pang, 2018. Cryptocurrency risk and Bitcoin as a new diversification tool.